The Tax Cut and Jobs Act passed by Congress last week and signed into law by the president on December 22, includes two provisions that directly impact middle- and high-income taxpayers’ 2017 and 2018 federal income tax returns and present an opportunity to reduce the possible tax increase from those provisions by taking action before December 31, 2017.

Standard Deduction

The act substantially increases the amount of the standard deduction available to taxpayers who do not claim itemized deductions, with the result that many taxpayers who previously itemized deductions will use the increased standard deduction rather than itemizing deductions on their returns.

Deduction Of State And Local Taxes

Previously, state and local income taxes, including real estate and personal property taxes, were fully deductible as itemized deductions for federal income tax. The act includes a provision limiting the deduction allowed for those taxes to $10,000 each year for tax years beginning after December 31, 2017.

If a taxpayer whose deduction for state and local taxes normally exceeds $10,000 and make up a large part of total itemized deductions pays 2018 real estate taxes by December 31, 2017, those taxes are deductible in full as itemized deductions on the 2017 federal income tax return. Further, the taxpayer’s 2018 itemized deductions, reduced by the amount of the prepaid taxes, might be less than the increased standard deduction, allowing him a full deduction for the prepaid taxes on his 2017 tax return and giving him an additional deduction in 2018 of the amount by which the standard deduction exceeds his reduced amount of itemized deductions.

Exceptions

There are, however, two situations in which the prepayment of taxes would not obtain the desired result:

If the taxpayer is subject to the Alternative Minimum Tax (AMT), the prepayment would provide no tax savings because taxes are not deductible in determining AMT.

Prepayment of state or local income tax liabilities would not gain the desired tax benefit because the act contains a provision that payment in years beginning before January 1, 2018, of income tax liabilities for years beginning after December 31, 2017, are deductible only in the year in which the liabilities are incurred.

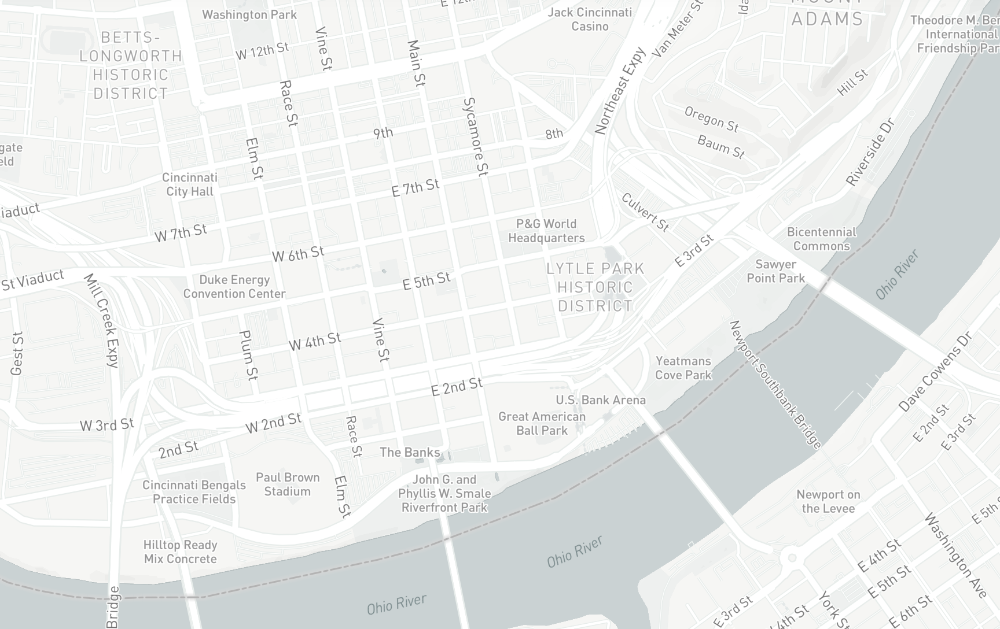

Bills for Hamilton County real estate taxes due in January 2018 can be obtained from, and payment of those liabilities can be remitted to, the Hamilton County treasurer’s office by December 31.

Bills for Warren and Clermont counties can be prepaid by submitting a check for the tax amount paid for the prior year before December 31. The checks must include the parcel ID number and “Prepayment” in the memo line.

If anyone wishes to prepay their January tax bill to Hamilton County, we will be happy to assist them by obtaining their tax bill from the treasurer’s office and depositing their payment at the treasurer’s office by December 31.